Congress Passes One-Year Extension of Business and Individual Tax Provisions

Introduction

Welcome to the informative page brought to you by Richardson Law Firm PC, where we discuss the recent one-year extension of business and individual tax provisions by Congress!

What is the Extension?

Congress has recently passed a significant extension of various tax provisions that affect both businesses and individuals. This extension provides stability and certainty, allowing taxpayers to better plan for their financial future. Richardson Law Firm PC, being experts in Law and Government matters, is here to give you a detailed overview of the essential elements of this extension.

Individual Tax Provisions

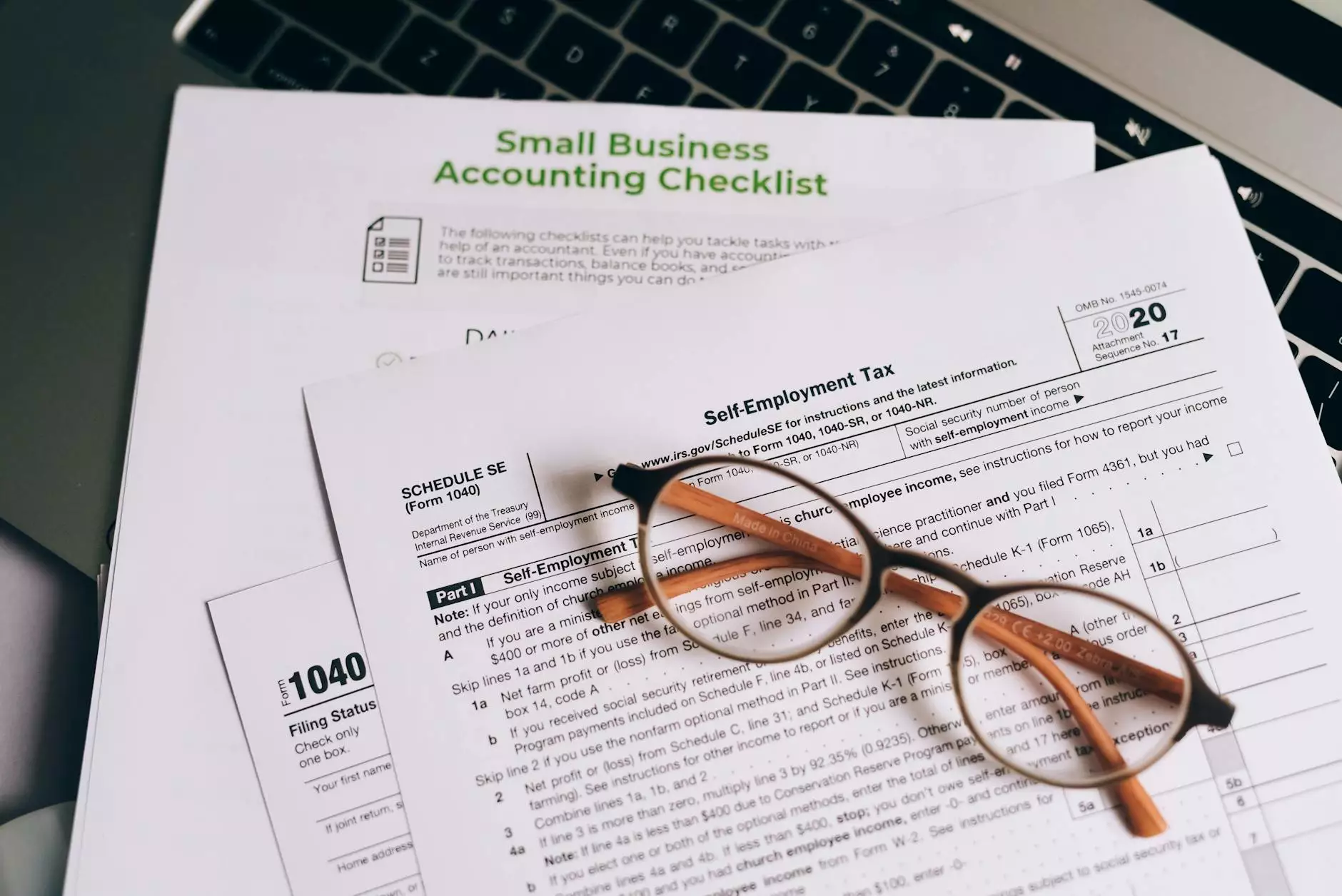

Under this extension, several key individual tax provisions have been prolonged for an additional year. Firstly, the Child Tax Credit has been expanded, providing increased financial assistance to eligible families. Additionally, the popular Earned Income Tax Credit will continue to support low-income workers. It is important for individuals to be aware of these provisions as they can significantly impact their tax liabilities. Our expert team at Richardson Law Firm PC can guide you through the necessary steps to take advantage of these extensions.

Business Tax Provisions

Businesses are not left behind in this extension. Congress has extended various tax provisions to provide essential support and incentives for businesses of all sizes. One notable provision is the continuation of the Research and Development Tax Credit, allowing companies to receive tax relief for qualifying research activities.

Furthermore, the Section 179 Expense Deduction has been preserved, enabling businesses to deduct the full cost of qualifying equipment and property purchases. This can be a tremendous benefit for businesses looking to invest in their growth and expansion.

Implications for Tax Planning

With the one-year extension of these business and individual tax provisions, it is crucial for taxpayers to reassess their tax planning strategies. Richardson Law Firm PC recommends consulting with our experienced tax advisors to ensure you are making the most of the extended provisions and optimizing your tax position.

Conclusion

In conclusion, Congress has passed a one-year extension of business and individual tax provisions, providing much-needed stability and predictability for taxpayers. Richardson Law Firm PC, as a dedicated law firm specializing in Law and Government matters, is ready to assist you in navigating these complex tax changes.

Contact Richardson Law Firm PC today to schedule a consultation and get expert advice tailored to your specific needs. Let us help you make the most out of the extended tax provisions!